5 Tips about chapter 13 bankruptcy You Can Use Today

Renters insuranceBundling renters & vehicle insuranceRenters insurance calculatorRenters insurance costBest renters insurance organizations of 2024Renters insurance firm reviewsWhat does renters insurance protect?

Steerage. Does the company give a qualified person who will listen and recognize your individual situation, and craft a prepare specifically for you? Or Do you need a more generic, off-the shelf selection?

He has presented beneficial lawful counsel to customers in complicated fiscal cases and he is nicely-Geared up to deliver thorough lawful assistance for A selection of organization-relevant difficulties.

In summary, bankruptcy and insurance are intertwined elements of economic management that require attention and cautious thing to consider. By knowledge how bankruptcy could impression your insurance and proactively controlling your protection, you can shield your passions, property, and fiscal perfectly-being through the bankruptcy procedure and past. Normally seek out Experienced direction to navigate these elaborate matters effectively.

We worth your have confidence in. Our mission is to supply visitors with exact and impartial details, and We now have editorial criteria set up to make sure that happens. Our editors and reporters thoroughly simple fact-check editorial information to make certain the knowledge you’re looking at is accurate.

Exactly what is a Secured Bank card? How It Works and Gains A secured bank card can be a kind of charge card that may be backed by a income deposit, which serves as collateral should you default on payments. A secured card can rebuild credit score.

Simply click by means of these sections to know regardless of whether Chapter 13 bankruptcy is best for you and the way to rebuild from bankruptcy.

If you're contemplating filing for bankruptcy, you're not alone. Each year, a huge selection of hundreds of people file for bankruptcy as a consequence of their mind-boggling personal debt.

In now’s world most, if not all folks feel uneasy speaking about their finances – significantly when it issues the topic of private bankruptcy. Nobody hopes to confess that she or he has blog here basically been as a result of the process because of The point that the one data virtually all folks have is the things they listen to from friends and family Together with the media, that is so generally negative and in addition sensationalized.

Buyers might also utilize the no cost self-aid means on This website or entry the internet site resources that seem beneath “Purchaser Debt Details”.

Here is how a typical Chapter 13 bankruptcy proceeds – from filing the petition to receiving the discharge.

Most of one's debts are student financial loans, boy or girl aid or other debts that possibly can’t be or are hugely unlikely to be discharged underneath Chapter 7.

Chapter thirteen bankruptcy takes for a longer time than another widespread sort of purchaser bankruptcy, Chapter seven, which forgives most sorts of financial debt, Extra resources like credit cards, health-related expenses and private loans.

Significantly of your bankruptcy course of action is administrative, nonetheless, and is performed clear of the courthouse. In cases beneath chapters 7, 12, or thirteen, and occasionally in chapter description 11 instances, this administrative approach is completed by a trustee who's appointed to supervise the situation. A debtor's involvement While using the bankruptcy decide will likely be incredibly confined. A normal chapter seven debtor will not show up in courtroom and will not begin to see the bankruptcy choose Until an objection is raised in the situation. A chapter 13 debtor could have only to seem before the have a peek here bankruptcy judge in a plan confirmation Listening to. Ordinarily, the one official proceeding at which a visit site debtor will have to show up is definitely the meeting of creditors, which is frequently held on the places of work on the U.S. trustee. This Conference is informally referred to as a "341 meeting" because part 341 of your Bankruptcy Code calls for the debtor go to this Conference to ensure that creditors can concern the debtor about debts and property. A fundamental objective from the federal bankruptcy legislation enacted by Congress is to present debtors a financial "new commence" from burdensome debts. The Supreme Court produced this stage about the goal of the bankruptcy legislation in the 1934 final decision: [I]t offers for the truthful but regrettable debtor…a different prospect in everyday life and a clear field for upcoming exertion, unhampered through the pressure and discouragement of preexisting financial debt. Local Financial loan Co. v. Hunt

Edward Furlong Then & Now!

Edward Furlong Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Elisabeth Shue Then & Now!

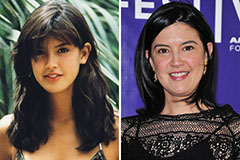

Elisabeth Shue Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!